HMRC’s new Making Tax Digital scheme (MTD) plans to revolutionise the way businesses handle their taxes by shifting towards a more efficient and pragmatic approach, believed to generate £610 million in extra revenue in 2020-21. A significant beneficial impact on businesses is predicted, with real-time record keeping being one of the main advantages.

Only Making Tax Digital for VAT currently has an actual roll-out date, with all other business taxes following in 2020 at the earliest. Below, Sage's Keir Thomas-Bryant provides advice on how to adjust to the new digitised system, complete with a Making Tax Digital checklist to aid your preparations.

How will MTD for VAT affect your business?

Companies that are VAT-registered with a taxable turnover above the VAT threshold will need to:

a) Ensure that their VAT records are preserved digitally

b) Send VAT returns to HMRC through Making Tax Digital-compliant software

On the HMRC website, VAT Notice 700/22 highlights which records must be kept digitally. The date when you must start keeping digital records and submitting your VAT return via MTD-friendly software will vary, since it depends on when your VAT period starts.

When do I have to start following the rules?

You must become MTD-compliant from the first day of your first VAT period, beginning on or after the 1st of April 2019. After this date, you will not be able to complete the traditional paper-based VAT return, or manually complete your VAT return online via the HMRC VAT portal.

When does Making Tax Digital officially begin?

The 1st of April 2019 is when Making Tax Digital will officially be mandated, affecting most businesses. However, for deferred businesses (approximately 3.5% of businesses), Making Tax Digital will begin from October 2019.

Am I still able to use a spreadsheet for record keeping?

There are a number of reasons why filing your VAT using spreadsheets alone isn’t going to meet the requirements of MTD for VAT. Many accountants regard spreadsheets as a sacred tool and unfortunately they will have to abandon their preferred method of record keeping. HMRC has argued that it can be incredibly easy to make errors in spreadsheets, consequently distorting tax data. Getting a formula wrong can result in being penalised for incorrect payments.

Thankfully, HMRC is offering businesses a 12-month period during which they will be able to directly transfer data from spreadsheets into MTD-compliant software.

Which software should I use to adjust to MTD for VAT?

According to HMRC, to be MTD-compliant, software must:

- Be able to store digital records relating to VAT

- Be able to send data to HMRC information and returns from data held in digital records

- Be able to receive information from HMRC

The best Making Tax Digital software will be able to complete all of the above. Using more than one application can make things slightly more complicated, since all the software you’re using will need to be digitally linked, and you won’t be able to manually copy information from one system onto another.

What are digital links for MTD for VAT?

As stated above, it’s paramount that any software that you use is linked so that you can create a digital journey for your VAT payments. Digital links are able to transfer data between different software and computer systems, including spreadsheet formulae to help assist in VAT calculations. Businesses will have to ensure that this is set up ready for further Making Tax Digital schemes introduced from 2020 onwards.

What is a digital record?

As you already know, when filing for VAT you must keep a record of your documents. With Making Tax Digital, you have to ensure that these records are kept digitally using MTD software. There will be some records that won’t need to be stored digitally to complete your VAT return. However, good accounting software will ensure that these documents are stored regardless. Working with such software will help prepare you for further Making Tax Digital implementation in 2020 and beyond.

What digital records do I have to keep?

The majority of firms will need to keep a record of each invoice, the time and date of supply, the net value, and the rate used to calculate VAT. The amount of information that you have to keep depends on the VAT scheme you currently operate under.

However, it’s important to note that all accounting software will record more information than this, which is paramount to running your business financials as efficiently as possible.

Different VAT Schemes

There is an array of different VAT schemes under which businesses operate. The VAT Notice 700/22 explains what information needs to be recorded and preserved digitally for each of them.

1. Flat Rate Scheme

This is one of the more common schemes used by businesses. If you are a small firm using the flat rate scheme, then you don’t need to keep a digital record of your purchases unless they are capital expenditure goods, on which input tax can be claimed.

2. Retail Scheme

Businesses using a retail scheme must ensure that they keep a digital record of their daily gross takings (DGT). It is not obligatory to have a separate digital record of the supplies that make up your DGT within compatible software.

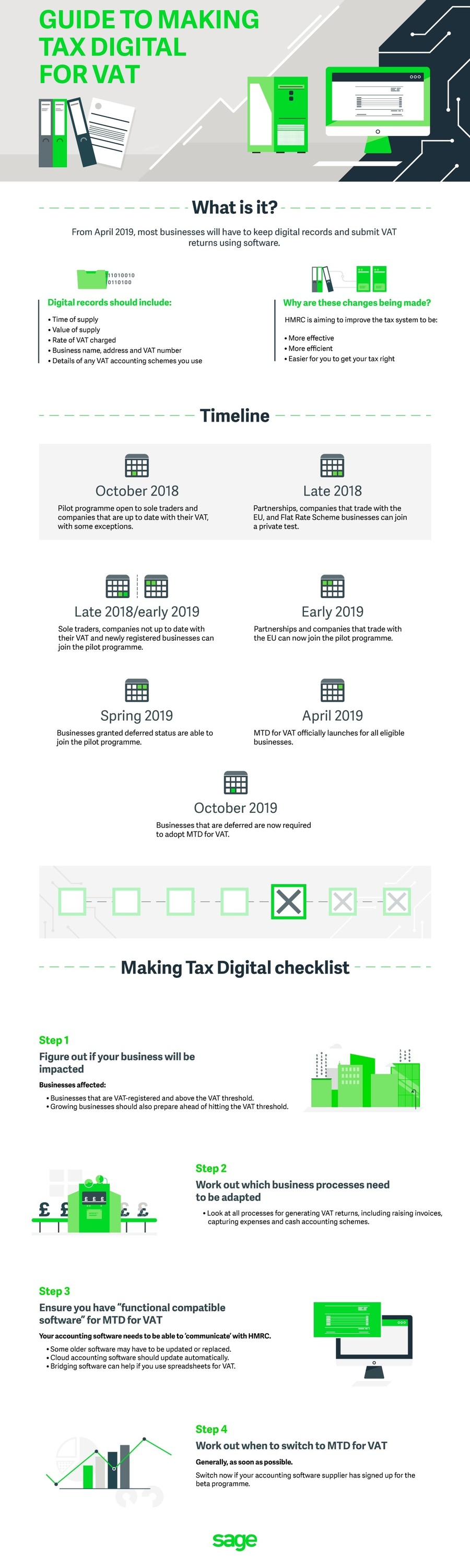

Visual Checklist for Making Tax Digital

If you want a quick rundown of the key points, refer to Sage's infographic below which outlines crucial dates. It also includes a handy checklist highlighting four simple steps to prepare your business ahead of the deadline.

Provided by Sage

If you'd like further insight into preparing your business for the deadline, take a look at our recent article exploring common misconceptions about Making Tax Digital.

About the Author

Keir Thomas-Bryant is Sage's dedicated expert in the small business and accountant fields. His role involves managing the global content component of Sage's small business and accountant campaigns. Keir has over twenty years of experience as a journalist and a small business owner, and cares passionately about the issues facing businesses worldwide.

These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. They are capable of tracking your browser across other sites and building up a profile of your interests. This may impact the content and messages you see on other websites you visit.

If you do not allow these cookies you may not be able to use or see these sharing tools.